Many people think that the CVV, a security feature found on a credit card or debit card, is the same as the PIN of the card. But there is a difference between the two. So, What is CVV? While the PIN is the number or code that the card owner uses to “lock” and “unlock” it and prevent others from accessing it to withdraw cash or purchase products, the CVV, on the other hand, is a security number that is printed on the card. It is a code that has three to four digits, and it functions as an additional security feature that kicks in when making card transactions wherein the cardholder does not use the card physically.

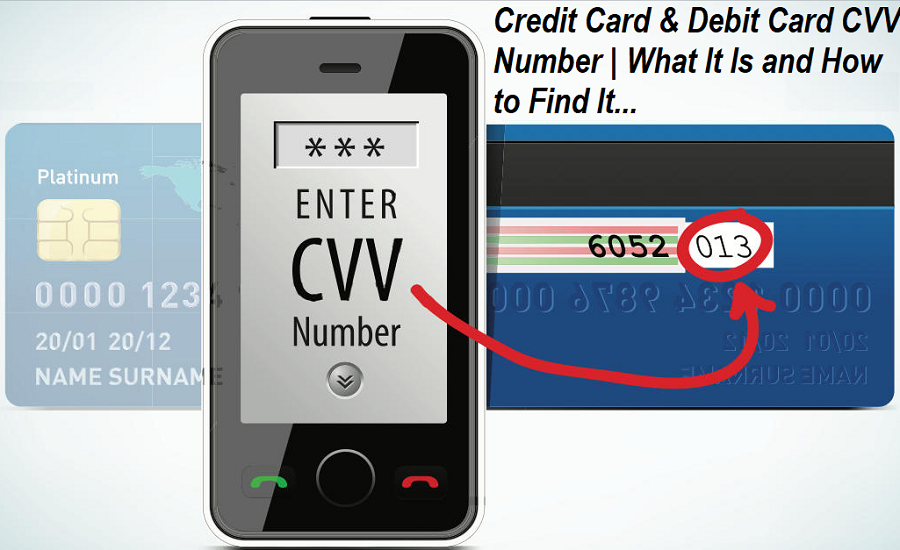

Credit Card and Debit Card CVV Number | What It Is and How to Find It on Visa and MasterCard

The CVV is useful when one is using a credit or debit card for making online purchases or making a transaction over the phone. Its implementation was in the latter years of the 1990s to respond to the need for security measures to protect consumers who were then starting to do online shopping. Many people began buying products and services from the internet, and at the time, many were not very conscious of the risks they were taking when providing credit card information.

The immediate popularity of online shopping and the sudden growth in the number of online shops prompts unscrupulous individuals to come up with scams. To protect consumers and online sellers both, the credit card company creates CVV as additional protection for security reasons.

An Evolving Security Code of Debit and Credit Cards

Michael Stone from the United Kingdom was the first to come up with a comprehensive idea for the CVV and its functions. Stone was an employee of Equifax, a multinational consumer credit reporting agency, and his design has since been developed by others. Through the years, the CVV has evolved, and so have its various features.

Different technology security agencies and companies working for financial institutions also continue to improve these said security protection functions. While the basic concept behind the code remains the same, the CVV has since become known by different names. Some banks and financial institutions call it the CSC or the Card Security Code; others call it CVD or Card Verification Data. Then there are still banks that choose to call the CVV as CVC, which stands for Card Verification Value Code and sometimes as Card Verification Code.

In the beginning, CVV was an alphanumeric code of 11 characters but eventually, this was whittled down to the four or three-digit code that most institutions that issue credit and debit cards now use. Cardholders should not undermine the importance of the CVV when one uses a card to buy something online, and the seller or store requires the card’s CVV. The code has been very effective in bringing down the number of cases of phone, online, and mail order credit card fraud, and preventing criminals from accessing accounts.

The Difference Between the Use of the CVV2 and the CVV1

In a transaction, the POS uses either the CVV1 or CVV2. The swiper or credit card machine scans the CVV1 during swipe transactions, but the CVV2 is what is activated when the card cannot be swiped. It is the case during phone orders or online purchases or payments. The use of CVV2 is automatically activated if CVV1 is not functioning. The cardholders will supply the CVV2 number to further verify the card. The processor can recognize what is CVV as it is embedded in the credit or debit card’s magnetic strip.

The Security Benefits Card Security Codes Bring

As stated in Payment Card Industry Data Security Standard regulations, after a transaction, CVV2 data cannot be retained in any payment system. It is precisely why the CVV is an effective tool when it comes to protecting accounts. Even if hacked, databases will be useless because they do not contain card data as the data is immediately deleted and erased. Fraudsters can no longer manipulate CVV data.

Another essential security benefit of the CVV is that it is used to verify physical possession. When making transactions where the card is not present, the requirement of stating the CVV code will protect the card owner who has the card at the time it is being used. It is the code’s verification function. Credit card companies help customers understand how they can maximize the security and protection features of their cards by providing information on the given CVV and the developments in the technology behind it.

COMMENTS